Asset-Deal in France

Inhalt

I. What is an asset deal under French law?

a) Definition of "cession de fonds de commerce"

b) Form and procedure

c) Rights and obligations of the seller

d) Obligations of the buyer

II. Creditor protection

III. Employee protection

IV. The rights of first refusal

a) The right of first refusal under private law

b) The right of first refusal under public law

V. The taxation of "cession de fonds de commerce"

VI. Summary

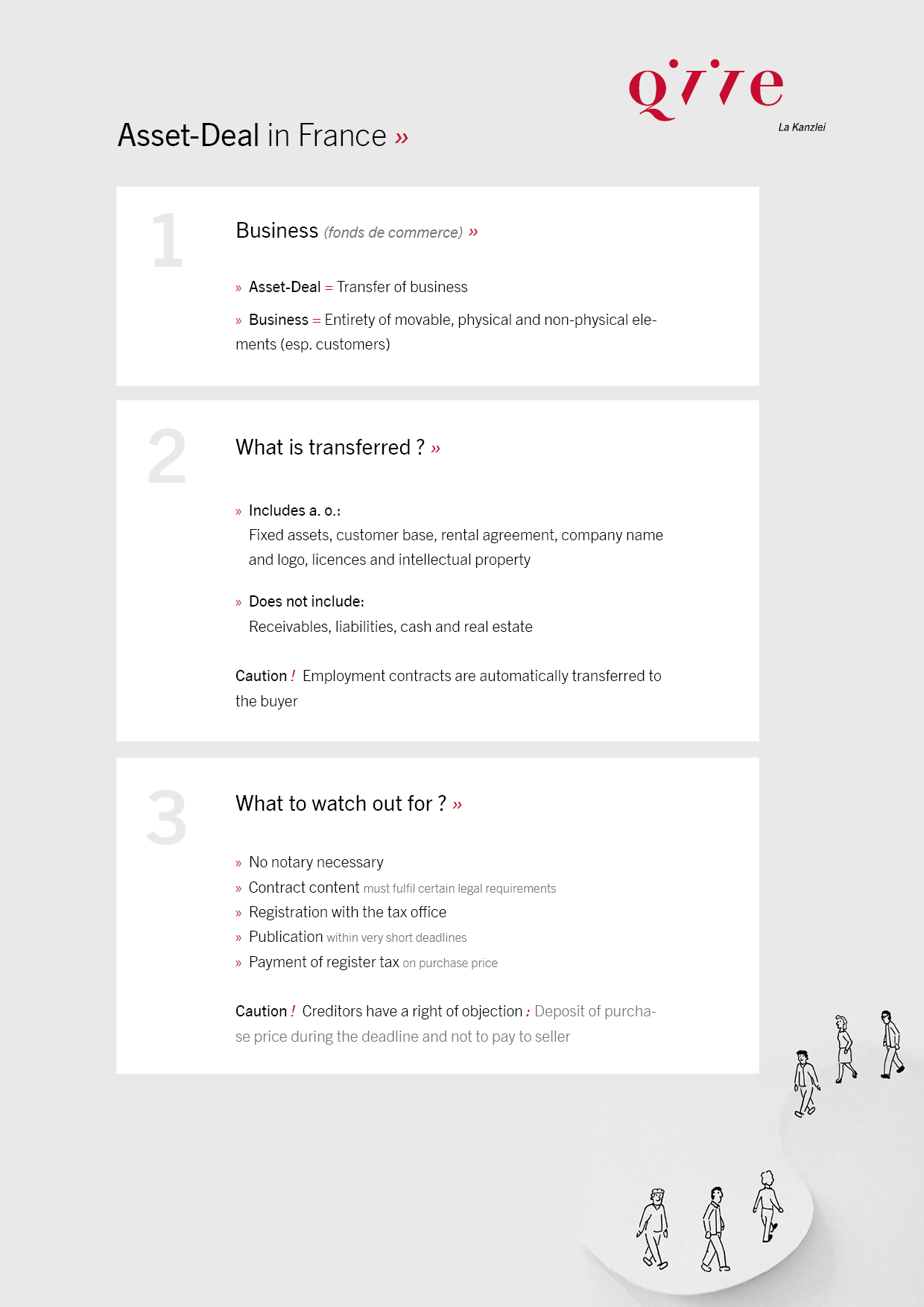

I. What is an asset deal under French law?

The term "asset deal" is an English term referring to the direct acquisition of the individual assets of a company and is to be distinguished from the "share deal", which refers to the acquisition of company shares. In the context of an asset deal in France, the common term is "cession de fonds de commerce", which could be translated in "transfer of business" or "sale of business operations". It is a complex legal structure in its own right.

Click here to download as PDF (Asset deal in France).

a) Definition of "cession de fonds de commerce"

The term fonds de commerce is defined as follows: It is a legal entity made up of the individual components (movable tangible and intangible elements) that a merchant maintains and organizes for the use of a customer base, the customer base being a legal entity that can also be distinguished from the other components. Since the customer base is the main element of a fonds de commerce, its transfer is also decisive for the applicability of the special rules to which the transfer of the fonds de commerce is subject. If the customer base is not transferred as well, several assets can be sold and transferred in bundles without being subject to the special rules of the cession de fonds de commerce. This is then a classic transfer of assets and economic goods, i.e. an asset deal.

In both cases, specific, individually and sufficiently concretely recorded assets are transferred, whereby receivables and liabilities of the concerned business or real estate are not automatically transferred as well, unless this is contractually agreed.

Attention: The transfer of a commercial lease (bail commercial) is subject to special rules. In most cases, the transfer of the commercial lease outside a cession de fonds de commerce without the landlord's consent is contractually excluded in the lease. However, on one hand, if the commercial lease is transferred together with the sole fonds de commerce, the landlord cannot oppose the transfer. In addition, commercial leases may contain special clauses, such as a preferential right in favor of the landlord. One the other hand, if a commercial lease is to be transferred along with the other assets, the prerequisites for the transfer must therefore be examined particularly thoroughly.

b) Form and procedure

The transfer of the fonds de commerce is subject to general French sales law, but also – and this is of particular importance – to the special provisions on the sale of a fonds de commerce pursuant to Articles 141-2 et seq. of the French Commercial Code (Code de commerce). In principle, the seller has a far-reaching duty to inform the buyer about the fonds de commerce. Therefore, information such as the list of pledges or the information on the commercial lease agreement is mandatory information that must be included in the sale and purchase agreement. If these details are missing from the sale and purchase agreement, this will be sanctioned with the nullity of the contract.

Practical tip: Until 2019, former Article L.141-1 of the French Commercial Code (Code de commerce) listed mandatory information that had to be included in any contract for the sale and transfer of a fonds de commerce. Failure to comply with this obligation resulted in the nullity of the contract. Although this article was repealed in 2019, it is still possible in principle to include this information voluntarily in the sale and purchase agreement, also in order to comply with the general information obligation mentioned above. In practice, in particular the information on the turnover of the last three financial years of the fonds de commerce is still included in the agreement. However, such a voluntary mention should be made without a written reference to the old legal provisions, so that the sanction linked to these provisions (i.e., nullity of the sale) does not apply.

In principle, no special form is prescribed by law for the conclusion of the contract of sale of a fonds de commerce. In practice, however, the sale is always realized by a written agreement. A notarial deed is only required if real estate is sold within the fonds de commerce.

Furthermore, in order for the transfer of a fonds de commerce to be effective, several prescribed formalities must be complied with. These formalities are summarized as follows:

|

No |

Type of formality |

Deadline |

|

1 |

Employees information and consultation on the sale, through staff representatives in companies with at least 50 employees |

At least 2 months before the sale (and up to a max. of 2 years before the sale) |

|

2 |

Tax registration of the sale and purchase agreement with the tax office of the sold fonds de commerce |

Within max. 15 days after signing of the sale and purchase agreement (within one month if the sale and purchase agreement has been notarized). |

|

3 |

Request for publication of a notice of sale in the French official journal for publications in civil and commercial matters (Bulletin officiel des annonces civiles et commerciales – BODACC) and in a local legal gazette (Journal d'annonces légales – JAL) |

Within 15 days after signing the sale and purchase agreement |

|

4 |

Notification of the change in the commercial register |

Within one month after signing the sale and purchase agreement |

|

5 |

Notification of the sale to the Centre de formalités des entreprises (CFE) and notification of VAT |

Within 30 days of the first publication of the sale |

|

6 |

Submission of the tax return by the seller to the tax office for companies (Service des impôts des entreprises) |

Within 45 days of the publication of the sale |

Practical tip: Due to the many deadlines, the non-observance of which has serious consequences, we advise in any case to draw up a transaction calendar in advance of the sale and purchase of the fonds de commerce.

c) Rights and obligataions of the seller

The seller's obligations under general sales law also apply to the transfer of a fonds de commerce. These are in particular:

- Procurement of ownership: The seller is first obliged to procure ownership of the fonds de commerce for the buyer. He may not interfere with the buyer's actual control over the object (e.g. handing over the keys).

- Guarantee of use: The seller must also ensure the undisturbed use of the fonds de commerce by the buyer. In particular, the seller may not engage in any activity within a narrow circle that would compete with the fonds de commerce of the buyer. The clear contours are regularly to be regulated in the sale and purchase agreement by means of a non-competition clause. Care is required in the wording of the non-competition clause, because a clause that is too broad would be void and would therefore completely lose its usefulness.

- Warranty of defects: The seller is also obliged to provide the sold fonds de commerce free of material and legal defects.

One of the special features of the transfer of a fonds de commerce is the so-called seller's privilege (privilège du vendeur). According to the latter, the seller is entitled to a so-called droit de suite on the fonds de commerce, according to which the seller, in the event of non-payment of the purchase price by the buyer, can sell the various components of the fonds de commerce in the following order: first the intangible components, then the business assets and finally the goods, and thus pay himself out of the sales price before all other creditors of the buyer.

Practical tip: In order for the seller to actually benefit from this resale right, the publication formalities, in particular the announcement of the sale within 15 days after signing the sale and purchase agreement, shall be strictly observed. Otherwise the latter will be deprived of the seller's privilege.

d) Obligations of the buyer

Under general sales law, the buyer's main obligation is to pay the purchase price consideration in accordance with the agreed conditions by the parties.

Attention: The seller's creditors in France have rights of objection and access to the purchase price to be paid. For this reason, the purchase price paid by the buyer is not paid directly to the seller, but in the vast majority of cases is first deposited with a trustee who is jointly appointed by the parties. The payment to the seller is usually made only approx. 5 months after the execution of the sale and purchase agreeement, when all existing liabilities have been fulfilled by the seller towards its creditors and the period of joint and several liability for tax purposes (période de solidarité fiscale), during which the seller is jointly and severally liable with the buyer for certain tax debts owed in the financial year of the sale and sometimes even from the previous financial year, has expired. However, this joint tax liability is limited to the agreed purchase price of the fonds de commerce and is valid for a period of 90 days after the seller submits the tax return to the corporate tax office.

If no trustee is involved and the purchase price is paid directly to the seller, the buyer bears a risk with regard to these liabilities; in particular the risk of being called upon by the seller's creditors should not be underestimated (see below).

II. Creditor protection

The protection of creditors is of particular importance in the transfer of the fonds de commerce. In principle, the creditors have the right to payment of their claims existing at the time of the sale and transfer of the fonds de commerce. Unlike in the case of a share deal, the buyer does not enter into the contractual relationships and is therefore in principle not liable for the seller's liabilities. However, due to the right of objection by the creditors, a claim against the buyer by the seller's creditors is not excluded. The buyer can only protect himself from this if the publication formalities are thoroughly executed. After the announcement of the sale, the creditors have a period of ten days to lodge an objection in order to have their claims settled directly by the trustee from the deposited purchase price. Creditors who have not lodged an objection within the time limit lose the right to contest the payment of the purchase price to the purchaser.

The seller may defend itself against objections by its creditors as follows:

- Cancellation of the objection (mainlevée): If an objection has been lodged by a creditor even though the claim is illegitimate or the objection is formless, the seller may apply to the court for the release of the purchase price (i. e. its payment). The application for release of the purchase price is admissible if there are no ongoing court proceedings regarding the claim.

- Limitation of the objection (cantonnement): If the amount of the lawfully raised objections is lower than the sale price of the fonds de commerce, the seller may apply to the president of the court (tribunal judiciaire) for authorization to release the difference.

III. Employee protection

There are also protective provisions for the employees of the company or the fonds de commerce in the context of the transfer of the fonds de commerce. As soon there are employees (up to 250 permanent employees, excluding trainees or temporary workers in particular), the seller is obliged to inform his employees on the contemplated sale. Depending on the number of employees of the fonds de commerce, the duty to inform must be carried out in different ways:

- Less than 50 employees: The employees must be informed of the sale by the owner (or the operator) of the fonds de commerce at least 2 months before the signature of the sale and purchase agreement of the fonds de commerce, but no earlier than 2 years before signing.

- More than 50 employees: As soon as more than 50 and up to 249 employees are employed, a works council (Comité économique et social) must be set up in the company. In this case, the employees must be informed at the latest when the employer involves this works council in the contemplated sale.

The aim of this information obligation is to give employees the opportunity to submit a purchase offer themselves. No documents or financial information of the company are to be presented to the employees. If this information obligation is not complied with, the seller faces a fine of a maximum of 2 % of the purchase price.

As an exception to this, no information obligation applies if the fonds de commerce is sold to a spouse or an immediate family member, or if the company holding the fonds de commerce goes bankrupt, or also if such information about the sale has already been given to the employees within the last 12 months.

Practical tip: As soon as the employees confirm receiving the information about the sale and do not wish to submit an offer, the sale can be concluded, even before the expiry of the two-month period. It is therefore often advisable to obtain a written waiver from the employees as soon as possible in order to be able to complete the sale without notice.

After completion of the sale, all employment contracts are automatically transferred to the buyer, who in principle cannot unilaterally change the employment contracts (e.g., he may not impose new probationary periods, even if new activities have been assigned to these employees).

IV. The rights of first refusal

In any sale of a business in France, pre-emption rights relating to the fonds de commerce must also be taken into account. The private pre-emptive right must be distinguished from the public-law pre-emptive right. As a rule, a private pre-emptive right only exists if a commercial lease is also sold together with the fonds de commerce or in the case of co-ownership (indivision). In the first case, it is a contractual right of first refusal, i. e. the commercial lease agreement must be thoroughly examined to determine whether such a right actually exists; in the second case, however, the right of first refusal is provided for by law.

a) The right of first refusal under private law

In both cases, the procedure is the same: the parties negotiate the essentialia negotii, i.e. the essential components, of the sale and only then do they have to involve the person entitled to the right of first refusal. The latter then has the right to move into the negotiated contractual relationship in the place of the potential buyer. If the parties do not take this right of first refusal into account, there is a risk that the substitution will subsequently be enforced by the party entitled to the right of first refusal.

b) The right of first refusal under public law

The scope of application of the public law right of first refusal is interpreted broadly and concerns not only the sale of the fonds de commerce, but any sale for consideration of commercial leases, fonds de commerce and craft fund (fonds artisanal).

Practical tip: Many tenancy agreements are contractually designated as commercial lease agreements, but do not comply with the legal requirements for this form of contract and are therefore not subject to the legal provisions on commercial lease agreements, i.e. also not subject to the public-law right of first refusal.

In contrast to the private pre-emptive right, within the framework of the public-law pre-emptive right, prior consent must be obtained from the municipality, or prior notification of the sale must be submitted to the municipality. The aim of this statutory pre-emptive right is to protect certain districts, so-called "protected areas of local crafts and commerce" (périmètre de sauvegarde de l'artisanat et du commerce de proximité), as it only applies in these determined districts.

V. The taxation of cesssion de fonds de commerce

In principle, the buyer owes the registration fees associated with the transfer in France. In exceptional cases, the parties may agree in the contract that these charges will be borne by the seller. These duties amount to 3 % for a purchase price amounting between € 23,000 and € 200,000 and 5 % for a purchase price above € 200,000.

The sale of the business assets leads to the termination of the business. Thus, the immediate taxation of the profits not taxed at the time of the disposal takes place. In addition, the profits generated by the disposal of the fonds de commerce itself are also taxed. The taxable value is the net book value of the fonds de commerce less the costs incurred in the transaction (e.g. legal fees). The taxation of the capital gain depends on the tax burden of the seller and the period during which he has operated the fonds de commerce. If he has held the business for less than two years, it is referred to as a short-term capital gain, for which the income tax rate is applied. If it has been held for more than two years, it is referred to in France as a long-term capital gain, which is taxed at 12.8 % plus 17.2 % social security contributions, i.e. a total of 30 %.

VI. Summary

- An asset deal in France differs in many respects from an asset deal under foreign law, particularly if the clientele is also transferred.

- Have experienced lawyers examine whether the special provisions of French law are applicable. In this case, you should avoid using model contracts under any foreign law, as too many adjustments are necessary, and the costs can quickly become disproportionate.

- Think about involving a trustee to avoid double payments to creditors of the seller

- Consult a French tax advisor who can also optimize the business for tax purposes.

12.09.2022